Disclaimer: This post is for information purposes only and not an investment advise. Please consult your investment advisor before doing anything. I am not liable if you lose money or if anything in this post is not factual.

So you’re at a stage where you hold a decent chunk of Indian equities, but would like to diversify your holdings to overseas companies. Everytime you use your phone or shop online, you are making money for non-US companies. There is a substantial part of value globally that is not captured by Indian companies. As such it might be a good idea to diversify your holdings globally.

As a resident Indian citizen you have many options –

- Open an overseas trading account offered by Indian brokerages.

- Open an account directly with an overseas brokerage firm offering access to US markets.

- Invest in a domestic mutual fund holding US equities.

I’ll be talking about each one of these options in detail. You can invest upto 250,000 USD every year overseas. You cannot buy/selling anything on margin, deal with Forex or buy Foreign Currency Convertible Bonds(FCCBs) from Indian companies. The full list of what is allowed and prohibited is available on RBI’s website.

Option offered by Indian brokerages

Kotak Securities, ICICI Direct, India Infoline, Reliance Money and Religare all offer an option of access to overseas securities. However I found that the local ICICI Bank branch had no knowledge about the same and they made no effort to help me out. I also learnt from someone that they charge very high fees.

So I didn’t try this option out, but it’s a good option to have.

Directly from foreign brokerages

There are a few foreign/US brokerages that allow you to buy/sell equities. The prominent ones are:

While some of these have dedicated teams to help you with an application from India, others do not. I chose TD Ameritrade as they had the lowest fees for the volume that I would be using. The per trade transaction cost is around 6.95 USD flat. The full price list for TD Ameritrade is present here. The list of documents I had to give digitally include:

- Filling out their form online , printing it and signing it.

- Aadhaar card and driving license for ID.

- Passport copy.

- Bank statements.

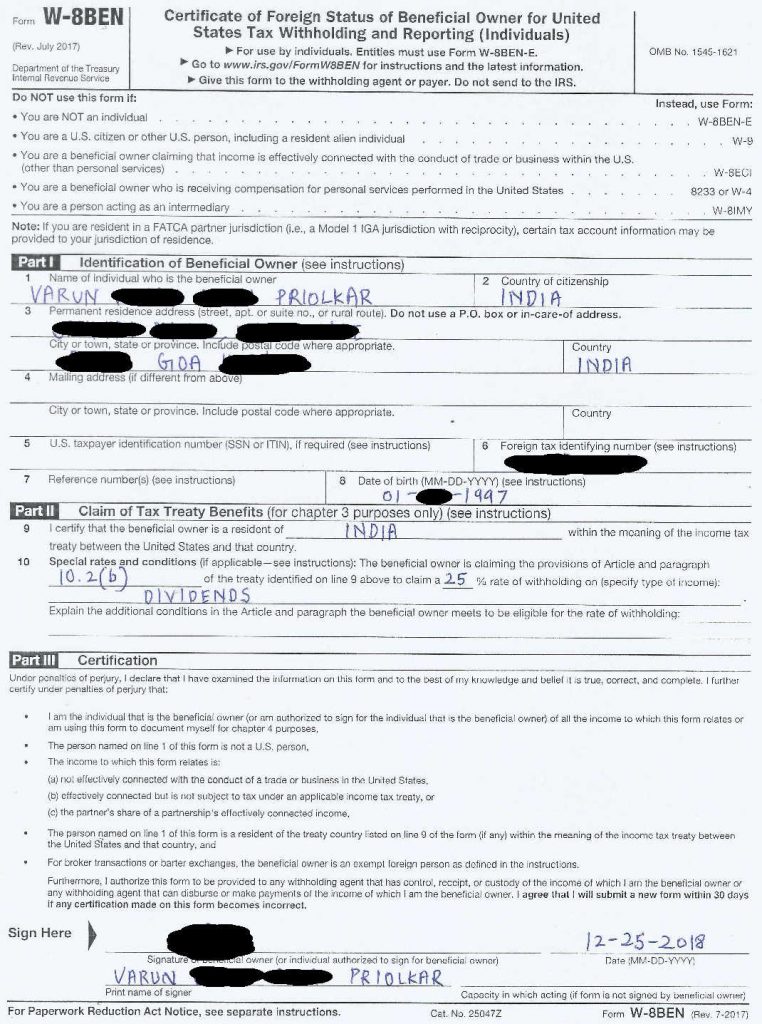

- W8-BEN form for tax declaration.

It took around 2 weeks for them to verify everything, although that could be because I had submitted everything during the winter holidays. While they do tell you to physically send the documents or fax them, they do accept documents over email too. You have to mail them to international@tdameritrade.com.

Taxation

India has a Double Taxation Avoidance Agreement(DTAA) with the US, which you can find on the Indian income tax website. In short for a non-resident alien:

- Capital gains will be taxed in India like debt. Taxes will not be withheld in the US by the broker.

- Dividends will be taxed at 25% in the US, which will be income from other sources. You can use deduction for these in India while filing your tax returns.

You may or may not need an International Tax Identification Number(ITIN) from US Internal Revenue Service(IRS). Authorised agents in India charge around ₹8000. I figured I didn’t need it and applied with just my Indian Permanent Account Number(PAN).

Most brokers should have an international accounts opening team to help you with taxation related queries and how to fill out the requisite forms.

Transferring money

While TD Ameritrade offered many options for transferring money, only Wire Transfer seemed like a practical solution, which most banks offer without questions asked. I found the transfer costs and the spreads for currency exchange to be excessive for ICICI Bank. Do let me know if you know an another option.

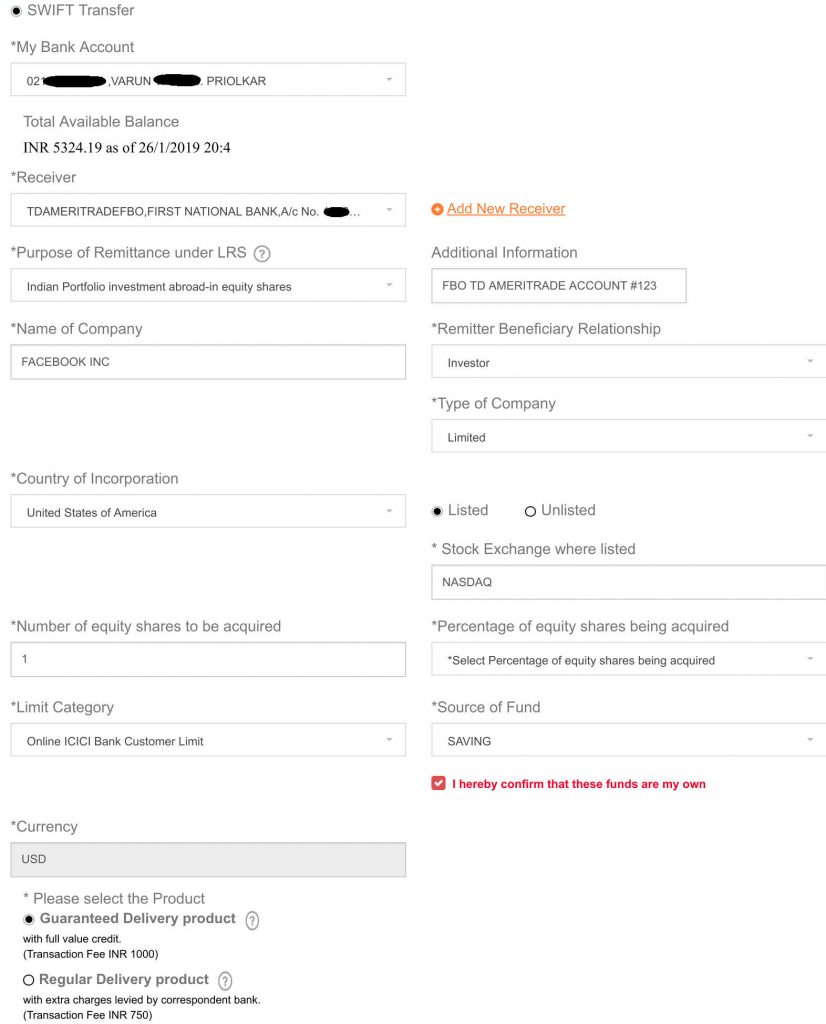

For the transfer you’ll have to fill out the form from the bank, which includes reasons for transfer, if you want like a regular/guaranteed transfer(regular transfer means the receiving bank could deduct some amount for fees, which was 6 USD on a 400 USD transfer for me). The brokerage will give you an account where you can transfer money to. For TD Ameritrade I had to add the For Benefit Of(FBO) number on the receiver’s details(next to the account holder name) and in additional information.

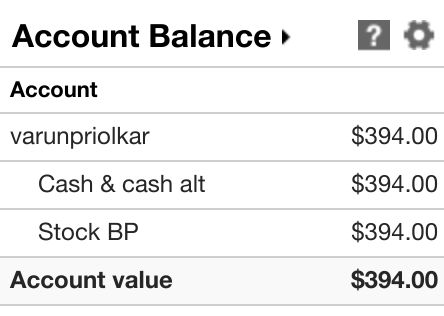

If you filled out everything correctly, you should see the amount in the brokerage account in a few days. It took nearly 5 days for me. It would have been nice if they had an Indian bank account to make the transfer fees lower.

Invest in Mutual Funds holding US equities

This is a relatively easy option, wherein you can buy Mutual Funds in India which hold US equities. Some of these are:

- Frankin India Feeder – US Opportunities Fund

- DSP US Flexible Equity Fund

- ICICI Prudential US Bluechip Equity Fund

- PPFAS Long Term Equity Fund – This fund has a part of it’s portfolio in international stocks but has > 65% of portfolio in Indian equities for getting equities treatment for taxation. It is one of my favorite funds.

If holding of Indian equities is < 65%, these the fund will be taxed like debt. Some of these funds also hedge for currency risks.

Thanks for reading. Do subscribe to my blog if you like the content. I will be covering more finance related topics in the future(along with the usual tech content). 🙂

How does taxes work when you already have an active trading account in USA and you have moved back to India for good? I use my trading account of USA sometimes but I am not sure on taxes for gains

Hi Amit,

It’s best that you contact a tax consultant who understands US and Indian tax laws to help you out. I don’t know much about how taxation there would work, sorry!

There are few hurdles:

(1) Threshold for U.S. Estate Tax on foreign citizens is $60,000/-. In case of demise of the holder, the U.S. brokerage would deduct 40% and give the remaining money back to the legal heir.

(2) Income tax officers in India don’t recognise omnibus model for capital gains because the shares are not held in the name of investor. The shares are held in the name of foreign brokerage. Highest applicable tax rate may apply.

(3) Because the shares are held in U.S. brokerage’s name, Indian investor takes credit risk of the broker. Think MF Global debacle. SIPC cover up to $500,000 may not apply to Indian citizen shareholders. This needs to be tested.

(4) Debt fund taxation makes it unattractive.

Very interesting. Thank you for the insight.

Umesh is right on (1). This is a big problem for Indian residents with big accounts in case of sudden death.

Hi Varun, thanks for the information. Much appreciated.

I want to know how to transfer back money to my Indian account. If I use TDA’s wire transfer option they ask me “Purpose of wire” and Indian bank’s corresponding bank in US. What are your thoughts? Is there any better way?

Hey Aseem,

I’ve not tried that as of yet. There is an option called “international wire”. Let me know how it goes.

Hi Varun, it’s been a while since you wrote this post. I wanted to know if you have now tried to transfer the funds back from TDA to your Indian bank account. Curious if it’s hassle-free. Thanks!

Hi Varun,

I am filling out the Form W-8BEN to open a TD Ameritrade account, just like you.

I am still unsure what to fill in Part II Line 10. If I leave it blank, will I automatically be taxed according to India’s DTAA with USA(since line 9 says I am an Indian citizen)? Or is it mandatory to fill this line?

If it is mandatory, what should I write in it?

I am curious how you found out about the Section 10.2(b) that you’ve mentioned in your form. Did you actually read the entire document?

I will be buying securities for long term with occasional swing/momentum trades (not intraday).

Can I use the same section as yours?

Hi Navneet,

You can use the same as mine, but I don’t assume any responsibility if things go wrong. You should consult your tax adviser before doing anything.

>I am curious how you found out about the Section 10.2(b) that you’ve mentioned in your form. Did you actually read the entire document?

Yes.

>If I leave it blank, will I automatically be taxed according to India’s DTAA with USA(since line 9 says I am an Indian citizen)?

From what I understand the withholding for dividends will be 30% instead of 25% if you do not fill this in.

Checking if the comments are getting posted. Please delete this one.

Yes, the comments work, but I have to approve them before they become live. That is why they aren’t immediately available on the website.

Hi Varun,

Thanks for sharing Information.

we can buy the stock online using TD Ameritrade account right? May I know why Facebook Inc was mentioned on wire transfer form?

Is it possible to Day trade US stocks using TD Ameritrade account?

I wish you all the best.

Thanks,

Yashwanth

>May I know why Facebook Inc was mentioned on wire transfer form?

Because I used the transferred cash to buy stocks of Facebook.

>Is it possible to Day trade US stocks using TD Ameritrade account?

I don’t think you can. LRS allows only long term investments as far as I know. I found some discussion on this topic here: https://tradingqna.com/t/trading-derivatives-in-usa-from-india/20239/16

As an Indian resident, we can only open a cash account and not a margin account (which allows you to settle cash immediately and also give you margin). With cash accounts, you can still do short term trading, like intra-day or for few days. But the problem is, once you sell a position the settled cash will be available after 2 days (T+1day). Because of this restriction, it will be more practical to do swing, trend or position trading where you hold the positions for few weeks. Hope this helps.

has anyone tried a new company called vested? seems a low priced option for indian investors

Looks promising, although I haven’t tried it yet. Do let me know how it works out if you decide to give it a try.

Hi varun,

awesome post, i was searching for this kind of post for a long time.

i have a few questions.

1. which bank did you use to wire transfer your money?

2.please do share about your experience in u.s stock market so far.

3 In total how much tax do i have to pay? is it worth it?

4.did you trade only facebook?

please do reply.

Thank you.

1. ICICI Bank, although using a PSU bank would be cheaper on the currency spreads and cost of transfer.

2. It’s been good. Most of my holdings are tech so could have recency bias.

3. AFAIK it’s taxed like debt so 20%+indexation for holding more than 3 years and income gets added to slab rate if you sell before that. Do keep in mind that you will have to disclose these holdings under section FA on income tax form.

4. I hold 4 different stocks, including tracking positions. I do not trade.

Hello Varun,

It seems that you holding stock for long term. I am also intending to do the same. Please guide me :

1. You have mentioned about $6.95 commission which Ameritrade on their website say that “A $6.95 commission applies to online trades of over-the-counter (OTC) stocks (stocks not listed on a U.S. exchange)” . That means it wont be charged if I buy US listed stock. Is that so ?

Does it also mean Ameritrade is also offering other global exchange’s shares ? I am also looking for some Australian market shares.

2. As you mentioned, you are disclosing your holding in your IT return. I hope there is no such hassle or query from IT department.

3. As I also want to hold it for long term. I hope there is no such monthly/yearly account management fee.

Please guide.

Thanks.

1. The commission has now been removed.

2. There can be additional scrutiny but if you are filing everything correctly, there is nothing to worry about.

3. There is none.

Hey Varun,

Thanks for the reply.

I have registered with TDA and ready to invest. Hope your holdings are going good.

OK. TDA gives access to only US markets.

Do you know any other reliable broker who gives access to Canada and Australian market ? And who is not charging for inactivity fees as Interactive Traders guys charge for inactivity monthly fee which is not good ?

I understand that one can buy Over The Counter securities from TDA itself, therefore I can put money on Auzzi and Canadian shares from TDA too. But Do OTA shares possess illiquidity issues ?

Your views please.

Thanks.

can we Invest in pink sheet stocks from TdAmeritrade

From what I understand, yes.

It is certified that remittance is not meant for overseas Forex Trading/Internet trading portal related transactions.

(SBI’s wire transfer T&C)

and there is no option for invensing in purpose of remittance

How can I transfer funds to my TDA account… Do I need demat account for that?

Sorry for delayed reply,

I’m using ICICI bank.

Hi Varun,

It’s been more than a year now since you posted this article. I am thinking about opening an account with TD as well.

Can you let us know if the steps and processes you mentioned in the article are still same or have they changed since then?

I think brokerage on both intra and inter day trading for equities are now 0, similar to that of off our discount brokers like zerodha. Can you confirm this?

Can you also share if there are any account opening/depositing and withdrawing charges involved here? How much time does it take to transfer money from my bank to TD and then withdrawing form TD to bank?

Thanks a lot for this…

I think they are the same. Correct, 0. Not sure about withdrawal, but depositing charges apply from side of bank you are sending money from. Usually a day to send money.

Hello Varaun.

Greetings.

First of all thank you for your detailed article. Before coming to you blog, I have struck up in filling the W8BEN form. Now i got answer from your blog. Thank you…

I have couple of questions.

TD ameritrades claiming zero commission while purchasing shares and etf…. Is it true.

If is yes means. Let say Microsoft trading at $146, what charges will attract buying one share…

$146 only or some charged… Plz let me know if you have purchased some stocks what are the charges, in India like base price+ brocker charges+ stt+ stamp duty etc… Same way can you elaborate how much cost buying one share of Microsoft base price of $146+ charges….

While selling also they charge? How much…

Generally in India after buying shares, NSE or BSE will confirm to buyer with an email saying DP have transaction these many share … Is this same after purchasing share in TD ameritrades will send a contract note, also from NYSE?

Is buying ETF also free commission.

Thank you for reply…

Hi Moula,

>If is yes means. Let say Microsoft trading at $146, what charges will attract buying one share…

$146 only or some charged… Plz let me know if you have purchased some stocks what are the charges, in India like base price+ brocker charges+ stt+ stamp duty etc… Same way can you elaborate how much cost buying one share of Microsoft base price of $146+ charges….

Buying most securities are free(zero brokerage charges), including stocks and ETFs. TDA sells order flow to make money.

>Generally in India after buying shares, NSE or BSE will confirm to buyer with an email saying DP have transaction these many share … Is this same after purchasing share in TD ameritrades will send a contract note, also from NYSE?

I haven’t got a contract note from NYSE. I am unsure of how this is handled but I do know that TDA is SIPC insured.

Hello Varun,

Nice post. Appreciate your proactiveness in responding to queries too.

If I may take liberty of sharing few questions of my own :

1. Transaction cost

“The per trade transaction cost is around 6.95 USD flat. ”

But on TDA site it says to buy US exchange registered stock, Online is $0 . How did you land up on $6.95 ?

2. “TDA sells order flow to make money.”

If you can extrapolate on this please.

3. Is there a email helpline where I may write for TDA Standard account? Unable to find that online.

4. Any minimum balance required to be maintained at TDA Standard account?

5. What are annual charges for TDA Standard account?

6. Will it make more sense to invest as HUF, rather than retail investor for a tax-efficient “post-death transfer” scenario?

For background, I am scouting to open a new brokerage & bank account.

–> My investment perspective is to invest into delivery-based – shares of Apple/FB/Berkshire of $5000 p.a. (appox 3.5 lacs- 5 lacs )

–> Hold stock for capital appreciation for 10+ years, rather than trade.

–> I am retail-individual Indian citizen, residing in India.

Questions are :

1. Which broker – will have least brokerage for this sort of investment ( considering per transaction, monthly, annual & redemption charges) ? TDA still recommended?

2. Which Indian Bank should we open the account , which can be linked to brokerage account – considering low cost of remittances to broker account?

1. I think that was earlier. It is now commission free.

2. Read this: https://www.warriortrading.com/payment-for-order-flow/

3. Not sure. For sending docs I’ve mentioned the same in this article.

4. No.

5. None AFAIK.

6. No idea. Consult your investment advisor 🙂

1. I’m sticking with TDA but I can see that there are other options like Vested as well today.

2. Tough question. I’m currently using ICICI as the remittance is super easy with their net banking but do have to shell out higher fees.

Isn’t ICICI 750/- + gst on 1% of amount invested? So 750 +180 for 1 lakh remittance. HDFC is 1000 + GST. So ICICI is cheaper than at least HDFC, dont know if there are cheaper ones out there.

TD doesn’t mention account closing fees(Webull has one), securities transfer fees(Webull has one), AMC, monthly activity fee or inactivity fee(IB has one) and they have no straight forward contact us option. Chatbots are useless and live chat people rarely appear when asked for.

Both charge most of markup on currency. Can go as high as 2.5-3%.

Buddy You Can Simply Give them a Call on thier Customer Care Number . Install Viber & Dial the Number. The Representative will address All of your Concerns

While transferring funds to TD Ameritrade account from HDFC Bank today i got this response. Can you guide with any alternative and can bank deny such request?

Thank you for using HDFC Bank’s Foreign Outward Remittance through Netbanking facility.

We regret to inform you that your outward remittance request with

Reference No.4158XXXX could not be processed for the reason: Beneficiary name in compliance list

Remittance to this beneficiary is prohibited under RBI regulations as trading in bitcoins is prohibited. Please submit a fresh request for other beneficiary.

I’m using ICICI bank.

Hi Varun,

I was looking for some info regarding Ameritrade and i end up in your Blog.

I am residing in USA and having trading account with ToS (Margin and No Commission)

I would like to know how’s your experience trading with Ameritrade from India. Do you have margin account or any minimum balance required and do you incur any commissions. Also, Can you trade PreMarket and After Market.

It would be of great help, if you could clarify my doubt. Thank you in advance.

Huda

I don’t use margin and don’t trade.

I got the same message as Jomy even though I used ICICI Bank.

@nikhil: were you able to transfer funds using ICICI Bank. I am planning to open ICICI bank account

@varun: Can you confirm the same if ICICI bank has some restriction in place now to transfer funds to TD Ameritrade

No restrictions for me.

@Nikhil: Were you able to transfer the funds using ICICI bank?

Hello Varun, thanks for this post. It did clarify quite a few questions I had with regard to TDA account opening process. Have an additional query; thinking you may have an answer to that from your exposure to TDA till date.

Q: Does TDA allow/enable “Options” trading for accounts opened by resident Indians?

thanks!

I’m not sure that’s allowed by LRS.

Great post man. It really helped me to open my account in TDAmeritrade.

But I have 2 issues while sending money from my account to TD.

One i don’t understand which details you need to enter in the icici swift transfer for td ameritrade.

There are two accounts numbers one is my original account but another account is given when i trying to wire transfer. I can’t understand FBO concept. There you have said that. you need to enter the account number in For benefit of.

One request can you provide the detail description of wire transfer from india bank account to TD. The complete process what details you need to enter, from where to collect and u can show ICICI bank as i will open that. It is very confusing as it is giving a pdf file where many things are given.

Account no. is to transfer money to TDA’s account. FBO is for TDA to identify the money sent should be forwarded to your brokerage account. Just make sure something like “FBO TDA Account no. #XXXX” is marked somewhere.

Even i have same query in ICICI page its asking ,*receiver Name and Address. i am not clear whether mine, or TD bank address. can you clarify where we have to give For credit to:

and For Benefit of:.

I suppose *Receiver Account Number is TD account with bank not trading account.

FBO=Further credit to

Receiver name/address would be TDA name/address. You can include something like TD Ameritrade Clearing INC FBO Account no. XXXX Rajesh Yoursurname in the name field there to be on the safer side.

You would also need to mention name and address of the bank on US side. Everything would be available on TDA website.

any body has any experience of working this online via hdfc bank? Pls let me know

Hi Varun,

If you may clarify following please :

1. Did you get the letter from TDA for applying ITIN ?

2. How did you manage ITIN application without agent ?

3. Do you file IRS return for taxation in India ?

1/2. I’m using PAN.

3. No. I only file with Indian Income Tax.

Hi Varun,

1. How did you figure you do not need an ITIN for opening broker account with TDA?

2. Was it the Indian PAN that you filled for Foreign Tax Identifying Number?

3. Seems there is Vested & Winvesta as well these days. Anyone tried those? Any suggestions on trading with Vested vs. TDA directly?

1/2. I’m using PAN, not ITIN.

3. Haven’t tried so can’t comment.

Hi Varun!

Can you tell me what Atlantic Union Bank’s offerings are?

It seems very tedious to transfer funds to the demat account in the US (If you don’t have an account in ICICI bank)

Also, do you know if tools such as Western Union/Transferwise work?

Thanks!

Hi Varun,

Thanks for this great article! It’s really helpful..

Very very useful first hand writeup for those wishing to tread NASDAQ/NYSE waters…. Have a few qns. Request your response whenever convenient to you.

1. If my spouse and I wish to open a joint account (to avoid estate withholding), should we choose account type under Standard account as “Joint Tenants with Rights of Survivorship (JTWROS)”

2. If I have an SSN and PAN, is it ok to give PAN given that we no longer live there nor file returns there?

3. Any expectation, that you need to file returns there (There is a Federal + State tax) even if tax has already been held back (25% of div) ?

4. For JTWROS, Is it ok if primary holder discloses Foreign Assets in Indian taxes for CG calculation & dividend tax offset?

5. Any inactive/non usage charges like Interactive or minimum liquid cash balance like Schwab One ($1000 at all times)?

6. On the online ICICI txfr, if you are splitting your remittance to buy FB, GOOG, MSFT, ADBE, NVDA do you have to mention All these names under “Name of Company” in SWIFT form. What if market moves by remittance time and you choose to drop one and add say BABA ADR? Again if you write 4 names, number of shares/fraction would be different right?

7. Any more cost/time efficient alternative to ICICI rack rates that you have mentioned?

Thank you

Jaya

Hi Varun,

Hope all well. Seeing your blog, started following Naval – very helpful and insightful . Any other folks you recommend following ?

PS – I’ve opened TDA account. I’ve received account no – but not able to login. TDA email help asks to call on their US number. Is this standard ? Bit naive & (feeling) stupid to ask – how did you access your TDA account after Welcome email ?

Sorry for the late reply. Yes, that’s standard.

Sorry had posted a few queries earlier, but doesnt appear. Maybe the form didn’t get submitted. Apologies incase this has reached your moderation queue (if any) twice.

1. If my spouse and I wish to open a joint account (to avoid estate withholding), should we choose account type under Standard account as “Joint Tenants with Rights of Survivorship (JTWROS)”

2. If I have an SSN and PAN, is it ok to give PAN given that I no longer live there nor file returns there?

3. Any expectation, that you need to file returns there (There is a Federal + State tax) ?

4. For JTWROS, Is it ok if primary holder discloses Foreign Assets in Indian taxes for CG calculation & dividend tax offset?

5. Does TDA have any inactive/non usage charges like Interactive or minimum liquid cash balance like Schwab One ($1000 at all times)?

6. On the online ICICI txfr, if you are splitting your remittance to buy FB, GOOG, MSFT, ADBE, NVDA do you have to mention All these names under “Name of Company” in SWIFT form. What if market moves by remittance time and you choose to drop one and add say BABA ADR? Again if you write 4 names, number of shares/fraction would be different right?

7. Any more cost/time efficient alternative to ICICI rack rates that you have mentioned?

Nice effort to list out various steps in the process. Its a God send.

I will try and share my thoughts as i have an account with Interactive Brokers (IB).

1. IB did not allow me to open a joint account, only individual account.

2. Did not give my SSN, only PAN as I am now residing in India.

3. We only file taxes in India only.

4. No joint account allowed for me.

6. I mentioned one name like AAPL or MSFT when sending USD to the account. We mention that these funds will be used to buy shares in US exchanges anyway. After money is sent to the account, you can trade any stocks or ETFs, not just the one you mentioned in the application for LRS. We report all transactions during tax time. I trade lot of individual stocks/etfs.

7. So far I have only used ICICI.

Hope this helps. Happy trading.

Thank you for your detailed reply,

A JTWROS (Joint tenancy with rights of survivorship) is a little better to avoid estate tax withholding as the money will not be held up for a IRS tax audit like in an individual account if a/c owner passes away.

For transfer, banks like BOB / SBI are little cheaper though you have to go in person and fill 3 forms. you will have to wait for a while (as import/export Fx gets priority owing to the frequency/size of transaction) they speak to the dealer & give a concession on the TT rack rate depending on the relationship (years/transfer amt etc). Its worth only if you are doing above > 3-4 L as its otherwise a painful process waiting, filling forms etc. PSU banks have lowest rate, Private banks are in the middle, Foreign banks are more expensive (except DBS India but sadly it doesnt allow capital acct remittance S0001).

And yes, Interactive, Schwab & TDA are the best/safest bets for investors aspiring to build a decent sized PF.

I prefill the forms and keep for BOB. There is option of pre-booking price on CCIL too. Bank then applies a spread on top.

can we Day trade with leverage ? since you are directly opening account with TD, does it allow to do day-trade with leverage ?

I don’t think leverage is allowed. Not sure you can day trade.

Hello Varun, have you recently remitted money to your tda account from icici? Is the process still the same as shown in the icici screenshot here? (I’m mainly referring to the reason of remittance and FBO part). Please let me know.

Yes, same process.

Hi Varun,

need help, can you please provide detailed steps on how to transfer the money from ICICI account to TD Ameritrade account?, appreciate your help.

Thanks,

Amit

Can u trade in option, liking buying premiums of calls and puts, there is no margin involved here

No options allowed.

Can i buy today and sell tomorrow before trade settled?

Thanks for curating such a detailed article. I would like to know if there is any minimum that needs to be deposited while opening the account

No minimums, but it 10k USD min account value is preferable. Below that doesn’t make much sense as transaction costs involved are a lot.

Could you kindly let me know the cost involved in opening a new international demat acccount from any US brokerable firm.

No costs, it is free.