Disclaimer: This post is for information purposes only and not investment advise. Please consult your investment advisor before doing anything. I am not liable if you lose money or if anything in this post is not factual. I am not a registered investment advisor.

This is a post about my investing journey, tips to get started and my thoughts on investing. On popular demand I am writing more content on financial topics. While this post is India specific, I’m sure my international audience will find value in this write up too.

How I got started?

I was like your average Joe who would spend everything that he made, before I stumbled upon a couple of books that changed my outlook forever – Rich Dad Poor Dad and The Richest Man in Babylon. I highly recommend you read them to understand the value of investing money early.

It made me appreciate the old adage that you need to own a business which makes you money while you sleep if you don’t want to work for the rest of the life. Salaried jobs require you to work hard to make an income and you never know when you could lose your job. To better explain this, I’m going to link a Twitter thread by Naval Ravikant.

It is imperative to build a passive income stream and not to rely on one source of income. Passive income is amazing because it lets you make money without actually working for it. The most straightforward way to do so is to build a business. However that may not be always everyone’s cup of tea ☕ to do so. Small businesses have an incredibly high failure rate. Fortunately there’s an easy way to buy a part of a business and let someone else manage it for you – the stock market!

Next few years were a lot of experimentation, making money and losing it, lots of learning in the markets that hopefully I can share with you.

Financial Independence & Compounding

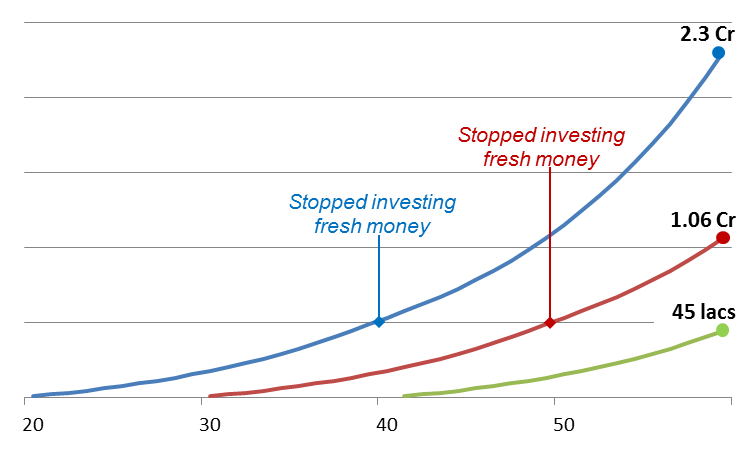

It is extremely important to start early and invest as much as you can, as early as you can. This will make sure you take advantage of a concept called compound interest. What it essentially is that you can use money from investment returns to make more money. Humans understand linearity far better than compounding. The best way to understand compound is with this chart.

A better way to put it would be that you would have to save 8 times inflation adjusted in your 40s than your 20s if you can make 15%(minus 4% inflation) returns. The same would be 22 times in your 50s. You get the idea. Once you get beyond a certain threshold, you may not have to actually work as it will not meaningfully contribute to your wealth.

More than anything financial independence is about control on your expenses and for this it is essential to get assistance from a professional in the field. A person with ₹4 lakh expenditure would require 1/3rd of corpus than someone with ₹12 lakh expenditure. Plus you free up the ₹8 lakh to invest so that you can grow your wealth. I found working from home and staying in smaller Tier 2/3 cities helps a lot in saving costs. It is extremely imperative to avoid pitfalls too, which include:

- Expensive liabilities – You may not really need to spend a lot of money on a car or that phone. Both of these are liabilities and depreciate. It is normal to spend ₹15 lakh on a car plus maintenance. Including EMIs, that money would be worth ₹43 lakh 5 years down the line if it was invested. A good rule of thumb is that a phone should not be more than 1-2% of your wealth and a car 5-10%.

- Debt – So many people my age spend money using personal loans, EMIs and credit cards. Debt to fund liabilities and not assets can be extremely destructive and can set you back years/decades if you are not careful. It is a surefire way to make money for your bank, not for yourself.

- Real Estate – I firmly believe that the house you live in is not an investment, but a liability. With low rental yields vs bond yields, it makes more sense in India to rent as well, not to mention the flexibility of moving anywhere you would like and not having to be saddled to an il-liquid investment.

The 4% rule is popularised by the FIRE(Financially Independent Retire Early) movement, which essentially means that if you can survive on 4% of your wealth, you can stop working. This takes into factor things like inflation. In India what you need would look something like this:

- Good start – $100k or ₹75 lakh

- Single person – ₹1.5-2 crores

- Family – ₹3-4 crores

More than what you invest in, investor behaviour is extremely important – staying the course, being patient, embracing volatility. Below is a great video that underscores this point:

Where to invest

Investing depends on a lot of factors like risk taking ability of a person, age, income etc. It is best that you hire a good investment advisor. The fees will be worth the money you lose on bad investments otherwise. Asset allocation is extremely important. There are a myriad of instruments you can invest in like Equity(stocks and Mutual Funds) that allow you to buy a part of a business, bonds, gold, real estate, REITs etc.

For family members I recommend keeping investments to beat inflation purely in Equity and keep cash in bank or liquid funds to cover expenses for the next few years, maintain liquidity. Extremely important point that people miss is that Equity is a 5-10 year instrument and not for the short term. Few products that I like:

- Nifty 50/Nifty Next 50 Index fund – Allows you to buy the largest 50/100 companies in the country. Low fees, little risk and no need to put too much thought towards investment.

- Quantum Long Term Value (link) – One of the few funds that actually practises value investing. Low beta, should beat index over long term.

- PPFAS Long Term Equity (link) – Transparent portfolio selection process, high insider holding(skin in the game), exposure to non-Indian businesses makes this a great holding.

- Motilal Oswal NASDAQ 100 ETF (link) – Great way to get exposure to US tech stocks.

- Quantum Liquid Fund (link) – Liquid fund that keeps money in short term government securities.

- Bharat Bond ETF (link) – Easy way to buy public sector bonds on the market.

- Individual stocks – I look for cash generating companies with easy to understand business models. Growth, ROCE, OCF/FCF, no/low debt/liabilities, strong balance sheet is what I look for. I have investments in consumption, pharma, tech in India and US. You can read my article on how to buy US stocks.

The reason I like liquid funds and bonds over fixed deposits is that these provide greater liquidity, you can choose if you want to take the interest rate risk, have far lesser taxes if you hold for more than 3 years and arguably safer looking at recent developments. One mistake I’ve seen is that people own too many things – too many mutual funds, stocks without focus.

Some useful resources:

- SIP Calculator – Calculate how much you need to invest to reach your goals.

- Zerodha Varsity – Great resource to learn about markets and investing.

- Screener – The best screener for Indian markets.

- Some blogs I like – Of Dollars and Data, Fundoo Professor, MicroCapClub, Safal Niveshak, WWA, Aroratop100.

I hope you found this post useful. I wish you the best in your investment career 😀

Great Read.!

I like this article.